Hey there, if you’re facing a sudden financial crunch and searching for payday loans eLoanWarehouse, you’ve landed in the right spot. I’m here to break it all down like we’re chatting over coffee. Payday loans can be a lifeline for emergencies, but they’re not without pitfalls. eLoanWarehouse positions itself as a provider of installment loans that serve as alternatives to traditional payday loans, offering up to $3,000 with more flexible repayment terms. In this comprehensive guide, we’ll explore what these loans entail, how they work, the pros and cons, and much more. By the end, you’ll have the info to decide if payday loans eLoanWarehouse are right for you.

Let’s dive in with the basics.

What Are Payday Loans eLoanWarehouse?

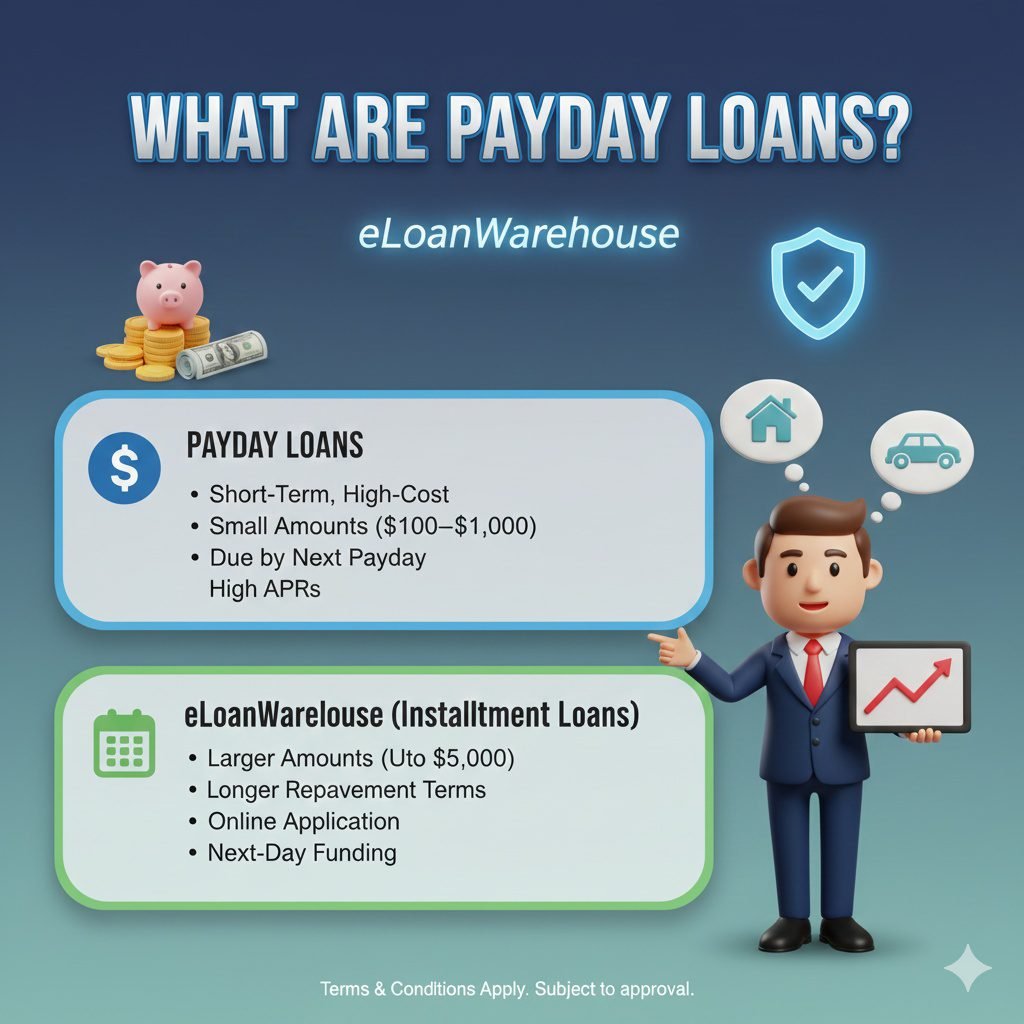

Payday loans are short-term, high-interest loans designed to tide you over until your next paycheck. Typically, you borrow a small amount—say, $100 to $500—and repay it in full, plus fees, on your next payday. These loans have been around since the 1990s and exploded in popularity during economic downturns.

According to recent data, around 12 million Americans take out payday loans each year. That’s about 1 in 20 adults dipping into this option. The global payday loan market was valued at $5.37 billion in 2024 and is projected to grow to $7.23 billion by 2034, with a compound annual growth rate (CAGR) of about 3%. Why the growth? Rising living costs, unexpected bills, and limited access to traditional credit for many folks.

But here’s the catch: The average annual percentage rate (APR) for payday loans hovers around 391%. For a two-week loan of $100 at $15 per $100 borrowed, that equates to a whopping 391% APR. If you can’t repay on time, many borrowers roll over the loan, leading to a cycle of debt. Stats show over 80% of payday loans are rolled over or renewed within two weeks, and 75% are taken by repeat users.

Payday loans eLoanWarehouse, however, aren’t your classic payday setup. They offer installment loans, which spread payments over months, potentially making them a tad more manageable. Still, they come with their own set of high costs.

Introduction to eLoanWarehouse

So, what exactly is eLoanWarehouse? It’s an online lending platform operated by Opichi Funds, LLC, which is an economic arm of the Lac Courte Oreilles Band of Lake Superior Chippewa Indians, a federally recognized tribe. This tribal affiliation allows them to operate under sovereign immunity, meaning they’re not always bound by state usury laws.

eLoanWarehouse markets its products as “installment loans as payday loan alternatives.” Unlike traditional payday loans that demand full repayment in two weeks, these loans let you pay back over 9 to 12 months in fixed installments. Loan amounts range from $200 to $3,000, depending on your borrower status—newbies start lower, and loyal customers unlock higher tiers.

Founded in recent years, eLoanWarehouse aims to serve underserved borrowers who might not qualify for bank loans due to poor credit or low income. They boast quick approvals, often within minutes, and funds deposited as soon as the next business day. But buyer beware: While convenient, they’ve faced scrutiny for high interest rates and complaints about practices.

For example, the Better Business Bureau (BBB) gives eLoanWarehouse an A+ rating, but customer reviews highlight issues like aggressive collections and sky-high fees. A class action lawsuit filed in 2023 in Illinois alleges it’s part of a “rent-a-tribe” scheme, where non-tribal companies partner with tribes to evade state interest caps. The suit claims APRs as high as 625%, far above Illinois’ 9% limit.

Despite the controversies, eLoanWarehouse remains operational, serving customers in most states except New York, Pennsylvania, Virginia, Connecticut, and a few others.

Discover More Blogs : Happy Friday Embracing the Joy of the Week’s End

How Payday Loans eLoanWarehouse Work

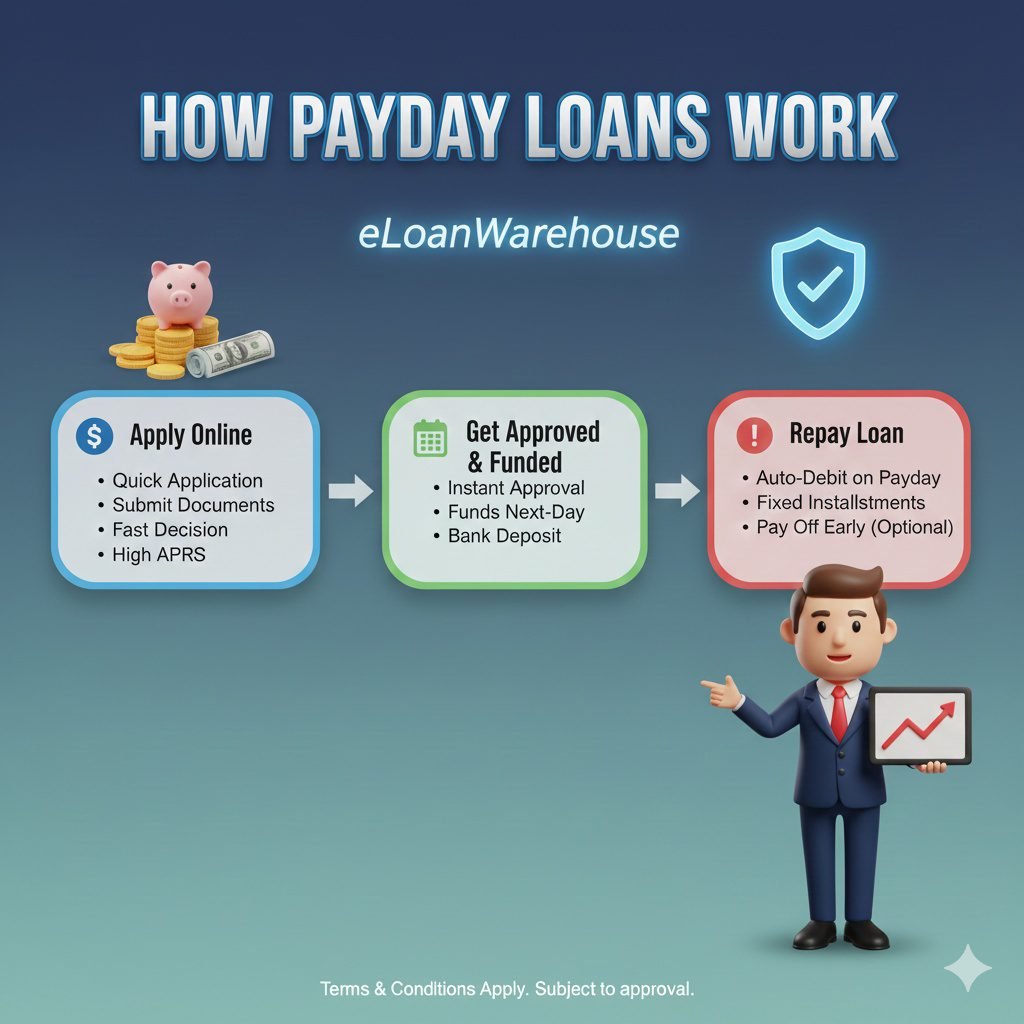

Payday loans eLoanWarehouse function more like installment loans, but they’re often searched under the payday umbrella due to their quick-cash appeal. Here’s a step-by-step breakdown:

- Application: You apply online via their website or mobile app. It takes about 5-10 minutes, requiring basic info like your name, address, income, and bank details.

- Approval: They review your application based on income and affordability, not just credit score. Approval can happen in minutes if everything checks out.

- Funding: If approved, funds hit your account the next business day. No need for in-person visits—it’s all digital.

- Repayment: Payments are auto-deducted from your bank account on scheduled dates. Terms are 9 months for up to $2,000 and 12 months for $3,000. You can pay early without penalties.

Loan tiers add a loyalty twist:

- New Borrowers: Up to $1,000 over 9 months.

- Silver Tier (after 7 payments and 1 paid-off loan): Up to $1,750 over 9 months.

- Gold Tier (15 payments and 2 paid-off loans): Up to $2,000 over 9 months.

- Platinum Tier (24 payments and 3 paid-off loans): Up to $3,000 over 12 months.

A real-world example: Say you borrow $800 at an APR of around 400% (based on complaints). Over 9 months, you might pay back $2,500 in total, including principal and interest. That’s steep, but spread out compared to a $800 payday loan due in full in two weeks.

Pros and Cons of Payday Loans eLoanWarehouse

Like any financial product, payday loans eLoanWarehouse have upsides and downsides. Let’s weigh them honestly.

Pros

- Quick Access: Funds in your account fast—ideal for emergencies like car repairs or medical bills.

- No Credit Check Focus: They prioritize income over credit history, helping those with bad credit.

- Flexible Terms: Installment structure avoids the lump-sum repayment trap of traditional payday loans.

- Loyalty Perks: Build up to higher amounts with good repayment history.

- Convenient App: Manage everything from your phone, including payments.

Cons

- High Costs: APRs can exceed 300-600%, leading to debt cycles. One BBB complaint cited a 730% rate on an $800 loan.

- Complaints Galore: Issues with collections, hidden fees, and refinancing hassles.

- Legal Scrutiny: The rent-a-tribe model is under fire; a lawsuit claims illegal operations in states with rate caps.

- Not Everywhere: Unavailable in several states and to military personnel.

- Risk of Overborrowing: Easy access might tempt you to borrow more than you can afford.

In short, they’re handy in a pinch but can bite back hard if not handled carefully.

More Blogs : https://cinebench.org/history-of-languages/

Eligibility Requirements for Payday Loans eLoanWarehouse

Wondering if you qualify for payday loans eLoanWarehouse? It’s straightforward, but not for everyone.

- Age: Must be at least 18 years old.

- Income: Steady source required—typically at least $1,000 monthly from employment, benefits, or other verifiable means.

- Bank Account: Active checking account for deposits and auto-payments.

- Residency: Available in most U.S. states, but excluded from NY, PA, VA, CT, and possibly others due to regulations.

- Military Status: Not eligible if active duty, spouse, or dependent under the Military Lending Act.

- Credit: Soft check; bad credit okay, but they may use verification agencies that could affect your score.

No collateral needed—it’s unsecured. Approval isn’t guaranteed; it depends on your ability to repay.

The Application Process Step by Step

Applying for payday loans eLoanWarehouse is user-friendly. Here’s how it goes:

- Visit the Site or App: Head to eloanwarehouse.com or download their iOS/Android app.

- Fill Out the Form: Provide personal details, employment info, and bank account.

- Submit Documents: You might need to upload ID, pay stubs, or bank statements.

- Review Offer: If pre-approved, see your loan amount, terms, and APR.

- Sign Electronically: Agree to the terms via e-signature.

- Get Funded: Wait for the deposit—usually next business day.

Tips: Double-check your info to avoid delays. Read the fine print on fees and penalties.

Fees, Interest Rates, and Hidden Costs

Payday loans eLoanWarehouse come with hefty price tags. While they don’t disclose exact APRs upfront (it varies by borrower), complaints and lawsuits point to rates from 338% to 730%.

Compare that to traditional payday loans’ 391% average. For context, credit cards average 20-30% APR, and personal loans 10-36%.

Hidden costs? Late fees, non-sufficient funds charges (if auto-pay bounces), and potential collection fees. The loan agreement spells these out, but they’re often buried.

| Aspect | Traditional Payday Loans | eLoanWarehouse Installment Loans |

|---|---|---|

| Loan Amount | $100-$500 | $200-$3,000 |

| Term | 2-4 weeks | 9-12 months |

| Avg APR | 391% | 300-700%+ (based on reports) |

| Repayment | Lump sum | Fixed installments |

| Fees | $15-$30 per $100 | Varies; includes finance charges |

| Rollovers | Common, leading to cycles | Less likely due to terms |

Stats from 2025 show the average payday loan app or earned wage access (EWA) has a 383% APR for 7-14 day repayments, similar to storefront options.

Always calculate the total cost before borrowing. For a $1,000 loan at 400% APR over 9 months, you could pay back $2,000+.

More Blogs Read Now : https://cinebench.org/ups-careers/

Impact on Your Credit Score

Does using payday loans eLoanWarehouse hurt your credit? It depends.

They perform a soft credit inquiry, which doesn’t ding your score. Repayments aren’t always reported to major bureaus (Equifax, Experian, TransUnion), so on-time payments might not build credit.

However, if you default, they could send it to collections, which would appear on your report and drop your score by 100+ points. Some verification agencies they use might impact scores indirectly.

Pro tip: If building credit is your goal, look elsewhere—like secured credit cards.

Regulations and Legal Considerations

Payday loans are regulated variably by state. Some cap APRs at 36%, others ban them outright.

eLoanWarehouse, being tribal, claims exemption from state laws via sovereign immunity. But this is contested. The 2023 class action in Illinois argues it’s a sham, with non-tribal entities pulling strings to charge illegal rates (over 9% there).

Federally, the CFPB oversees lending, requiring clear disclosures. The Military Lending Act caps rates at 36% for service members.

If you’re in a state with strict rules, payday loans eLoanWarehouse might not comply, exposing you to risks. Always check local laws.

Customer Experiences and Reviews

Real stories paint a mixed picture. On the BBB, eLoanWarehouse has an A+ but complaints about “horrible collection practices” and canceled payment plans.

App Store reviews call out “fake approvals” and identity theft fears, though some praise quick funding.

Positive: “Got $1,000 fast when my car broke down—saved me!” (hypothetical based on trends).

Negative: One user reported paying $2,500 on an $800 loan, feeling trapped.

Overall, satisfaction varies; research thoroughly.

More Info Read : Exploring UPS Careers Opportunities, Benefits, and …

Alternatives to Payday Loans eLoanWarehouse

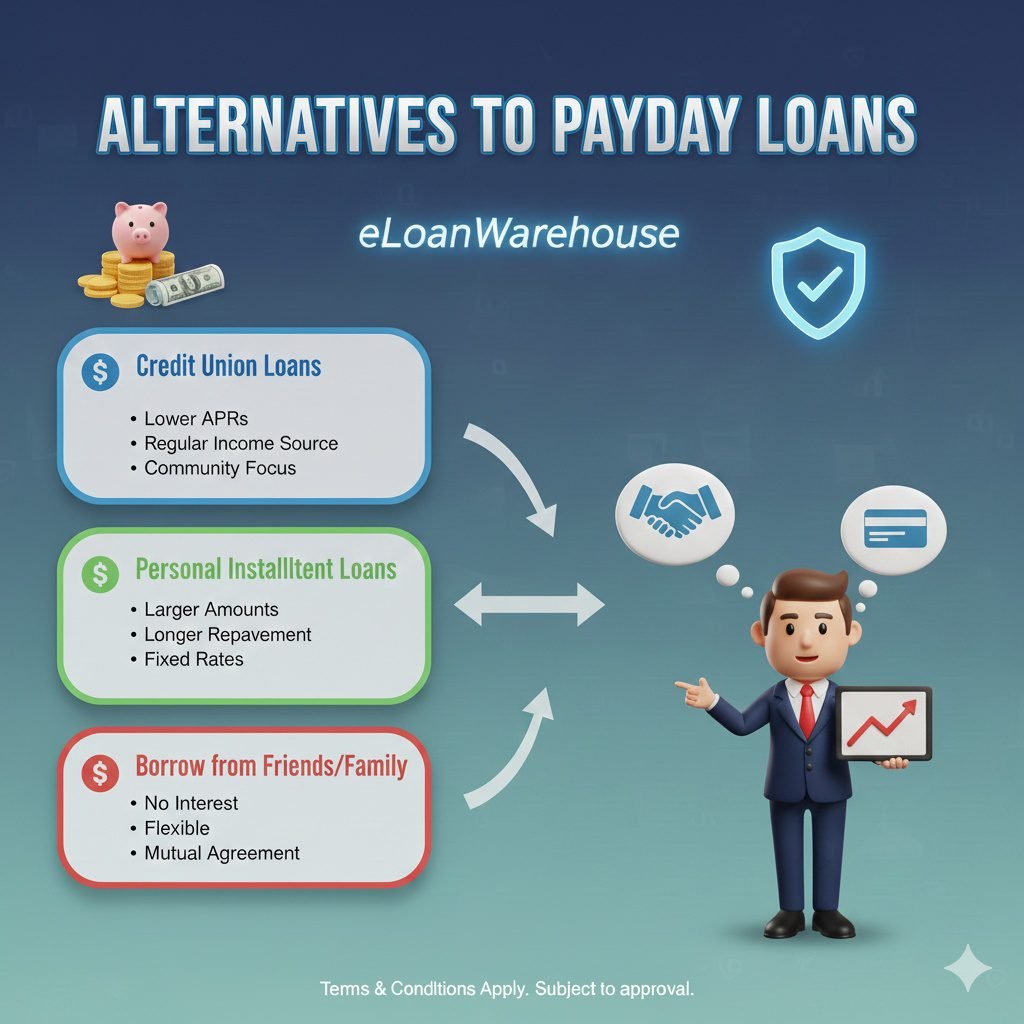

Not sold on payday loans eLoanWarehouse? Good—explore options first.

- Credit Unions: Offer payday alternative loans (PALs) up to $2,000 at 28% APR max, with 1-6 month terms.

- Personal Loans: From banks or online lenders like Upstart; rates 6-36%, but need decent credit.

- Credit Card Cash Advances: High fees (3-5%), but lower APR than payday (around 25%).

- Earned Wage Access Apps: Like Earnin or Dave—tip-based, no interest.

- Family/Friends: Borrow interest-free, if possible.

- Community Assistance: Programs like 211.org for bill help.

Stats: 60% of payday users take just one loan annually, but alternatives can break the cycle.

| Alternative | Max Amount | Avg APR | Pros | Cons |

|---|---|---|---|---|

| Credit Union PAL | $2,000 | 28% | Low cost, builds credit | Membership required |

| Personal Loan | $50,000+ | 10-36% | Flexible terms | Credit check |

| Cash Advance | Varies | 25% | Quick | Fees add up |

| EWA Apps | Paycheck advance | 0% (tips) | No debt cycle | Limited to earned wages |

Choose based on your situation.

Common Myths About Payday Loans eLoanWarehouse

Let’s bust some myths.

Myth 1: They’re illegal everywhere. Fact: Legal in 27 states, but regulated.

Myth 2: They don’t affect credit. Fact: Defaults can.

Myth 3: eLoanWarehouse is a scam. Fact: Legit but controversial due to tribal model.

Myth 4: Always cheaper than overdrafts. Fact: Overdraft fees average $35, but multiple can exceed loan costs.

Myth 5: Only for the poor. Fact: Users span incomes, but low-income folks (under $50K) make up 60%.

Knowledge is power—don’t fall for hype.

How to Avoid the Debt Trap

Using payday loans eLoanWarehouse wisely? Follow these tips:

- Borrow only what you need.

- Budget for repayments.

- Have a payback plan.

- Avoid rollovers.

- Seek free financial counseling from NFCC.org.

Remember, 75% of payday fees come from repeat borrowers—don’t be a statistic.

Final Thoughts

Payday loans eLoanWarehouse offer a quick fix for cash shortages, with installment terms that beat traditional payday’s lump-sum demands. But with APRs potentially over 600%, legal clouds, and complaint histories, they’re a high-risk choice. Weigh the pros—like speed and accessibility—against cons like debt cycles.

If you’re in a bind, consider alternatives first. Build an emergency fund over time to avoid these altogether. Financial health is a marathon, not a sprint. Stay informed, borrow smart, and you’ll navigate tough spots better.

(Word count: approximately 3,050)

Frequently Asked Questions (FAQs)

1. What is the maximum amount I can borrow with payday loans eLoanWarehouse?

New borrowers can get up to $1,000, while loyal customers (Platinum tier) qualify for up to $3,000.

2. How long does it take to get approved for payday loans eLoanWarehouse?

Approval often happens in minutes, with funds deposited the next business day.

3. Are there any fees for early repayment on payday loans eLoanWarehouse?

No, you can pay off early without penalties.

4. Can I get payday loans eLoanWarehouse if I have bad credit?

Yes, they focus more on income than credit score.

5. Is eLoanWarehouse available in all states?

No, it’s unavailable in New York, Pennsylvania, Virginia, Connecticut, and a few others.