If you’re exploring investment opportunities in the biotech sector, TNXP stock has likely caught your eye. As the ticker for Tonix Pharmaceuticals Holding Corp., this stock represents a company at the forefront of developing treatments for challenging health issues like chronic pain, mental health disorders, and infectious diseases. With recent product launches and a promising pipeline, TNXP stock offers both potential rewards and risks typical of emerging biopharma plays. But is it right for your portfolio? Let’s break it down.

Tonix Pharmaceuticals Selects EVERSANA to Support Launch Strategy …

Key Points on TNXP Stock

- Current Performance: As of December 7, 2025, TNXP stock trades around $19.64, with a market cap of approximately $230 million. It has shown volatility, hitting a 52-week high of $130 and a low of $6.76, reflecting biotech sector swings.

- Company Focus: Tonix specializes in central nervous system (CNS) therapies, with its flagship product, TONMYA™, recently launched for fibromyalgia management. Research suggests this could address a market affecting millions, though success depends on adoption rates.

- Financial Snapshot: The company reported total revenue of about $10.3 million in its trailing twelve months, but it’s still operating at a loss, with a net income of -$99.2 million. Evidence leans toward growth potential from its pipeline, but profitability remains uncertain.

- Opportunities and Risks: Positive FDA clearances and partnerships indicate momentum, yet high R&D costs and market competition introduce challenges. It seems likely that regulatory approvals could boost the stock, but investors should note the speculative nature.

- Investor Considerations: For those interested in TNXP stock, diversification is key given the sector’s debates around drug efficacy and commercialization hurdles.

Why TNXP Stock Matters in Today’s Market

Biotech stocks like TNXP often attract attention for their innovation potential. Tonix Pharmaceuticals, listed on NASDAQ under TNXP, focuses on repurposing existing drugs and developing new ones for underserved areas. This approach can speed up timelines compared to starting from scratch, potentially reducing some risks. However, as with many small-cap biotechs, TNXP stock has experienced sharp price movements tied to clinical trial results, regulatory news, and broader market sentiment.

Recent data shows TNXP stock’s volatility: from a low of around $7 in early 2025 to spikes above $50 amid positive developments. This pattern highlights how news-driven events can influence the stock, making it appealing for traders but requiring caution for long-term holders.

Discover More Blogs : Unlocking PC Power Your Ultimate Guide to Cinebench

Recent Trends in TNXP Stock

Over the past year, TNXP stock has navigated a turbulent path. Starting 2025 at around $1,337 (pre-adjustments for splits), it declined amid market pressures but rebounded with key announcements. For instance, the commercial launch of TONMYA™ in November 2025 contributed to a surge, with shares climbing over 40% in some sessions. Supporting data from sources like Yahoo Finance and Nasdaq indicate trading volume spikes during these periods, often exceeding 1 million shares daily.

While absolute highs from 2012 (over $1 million pre-split) aren’t comparable due to reverse stock splits, the evidence points to TNXP stock’s sensitivity to pipeline progress. Investors monitoring TNXP stock should watch for upcoming Phase 2 trial data, as these could sway sentiment.

TNXP Stock Price and Chart — NASDAQ:TNXP — TradingView

Tonix Pharmaceuticals Holding Corp. (NASDAQ: TNXP) is a clinical-stage biopharmaceutical company dedicated to discovering, licensing, acquiring, and developing therapeutics to treat and prevent human diseases, with a strong emphasis on central nervous system (CNS) disorders, immunology, infectious diseases, and rare conditions. Founded in 2007 and headquartered in Chatham, New Jersey, the company has evolved from its early roots in mining exploration (originally incorporated as Tamandare Explorations Inc.) to a focused biotech player since rebranding in 2011. This shift allowed Tonix to leverage repurposed drugs, accelerating development while addressing public health challenges.

The company’s mission centers on innovative solutions for complex, chronic conditions. For example, it targets nociplastic pain (like fibromyalgia), psychiatric issues, addiction, organ transplant rejection, autoimmune disorders, cancer immunotherapy, and biodefense against threats like mpox and smallpox. With a market cap hovering around $230 million as of late 2025, TNXP stock reflects the speculative yet high-potential nature of small-cap biotechs. Analysts, such as those from Stock Analysis, rate it as a “Buy” with a 12-month price target of $70, suggesting optimism amid its pipeline advancements.

Tonix employs about 50-100 people and operates with a lean structure, prioritizing R&D. Its stock, TNXP, trades on the NASDAQ Capital Market, and recent financials show a focus on commercialization following FDA approvals. While not yet profitable, the company’s cash position supports ongoing trials, with $225 million in assets providing runway for key milestones.

Historical Context and Evolution

Tonix’s journey began modestly, but by the mid-2010s, it pivoted fully to pharmaceuticals. A key milestone was its 2025 launch of TONMYA™ (cyclobenzaprine HCl sublingual tablets), the first new fibromyalgia treatment in over a decade. This product alone targets a U.S. market of 6-12 million patients, where current options often fall short in efficacy or tolerability.

Reverse stock splits—such as 1-for-100 in mid-2025—have adjusted share prices, explaining dramatic historical highs (e.g., $1,000,000 adjusted in 2012). These actions aim to maintain NASDAQ compliance but can dilute shareholder value if not accompanied by growth. Despite this, TNXP stock has shown resilience, with shares rebounding from lows of $6.76 in March 2025 to around $19.64 by December, driven by positive news like FDA IND clearances.

More Informations : Airplane Crash Unraveling the Facts Causes and Safety …

TNXP Stock Performance Analysis

TNXP stock has been a rollercoaster, characteristic of biotech volatility. As of December 7, 2025, the last quote shows a bid of $19.65 and ask of $19.88, with a closing price of $19.64 the prior day. Year-to-date, it has fluctuated wildly: starting high in January ($1,327 open, adjusted), dipping to single digits mid-year, and surging post-launch.

Key Performance Metrics

Here’s a table summarizing essential TNXP stock data (sourced from Yahoo Finance, Nasdaq, and Polygon API via code execution):

| Metric | Value | Notes |

|---|---|---|

| Current Price | $19.64 | As of Dec 5, 2025 close; slight uptick to ~$19.88 ask. |

| Market Cap | $230 million | Reflects ~11.7 million shares outstanding (approximate). |

| 52-Week High | $130 | Achieved amid pipeline hype. |

| 52-Week Low | $6.76 | Hit during market downturns. |

| P/E Ratio | -0.02 | Negative due to losses; typical for pre-profit biotechs. |

| Average Daily Volume | ~593,000 shares | Increases to millions on news days. |

| Beta (Volatility) | High (biotech average) | Sensitive to sector news. |

Historical data reveals patterns: TNXP stock often spikes on regulatory wins, like the 43% premarket jump in 2025 on pox vaccine patents. Conversely, misses in trials or dilutions from funding rounds pressure prices. For instance, from January 2024 ($1,327 close) to December 2025 (~$19.64), the stock adjusted for splits shows a net decline, but recent momentum suggests recovery potential.

A one-year chart illustrates this: steady declines through mid-2025, followed by sharp uptrends in Q4 tied to TONMYA™ availability. Investors tracking TNXP stock should note resistance levels around $30 and support near $15, based on recent trading.

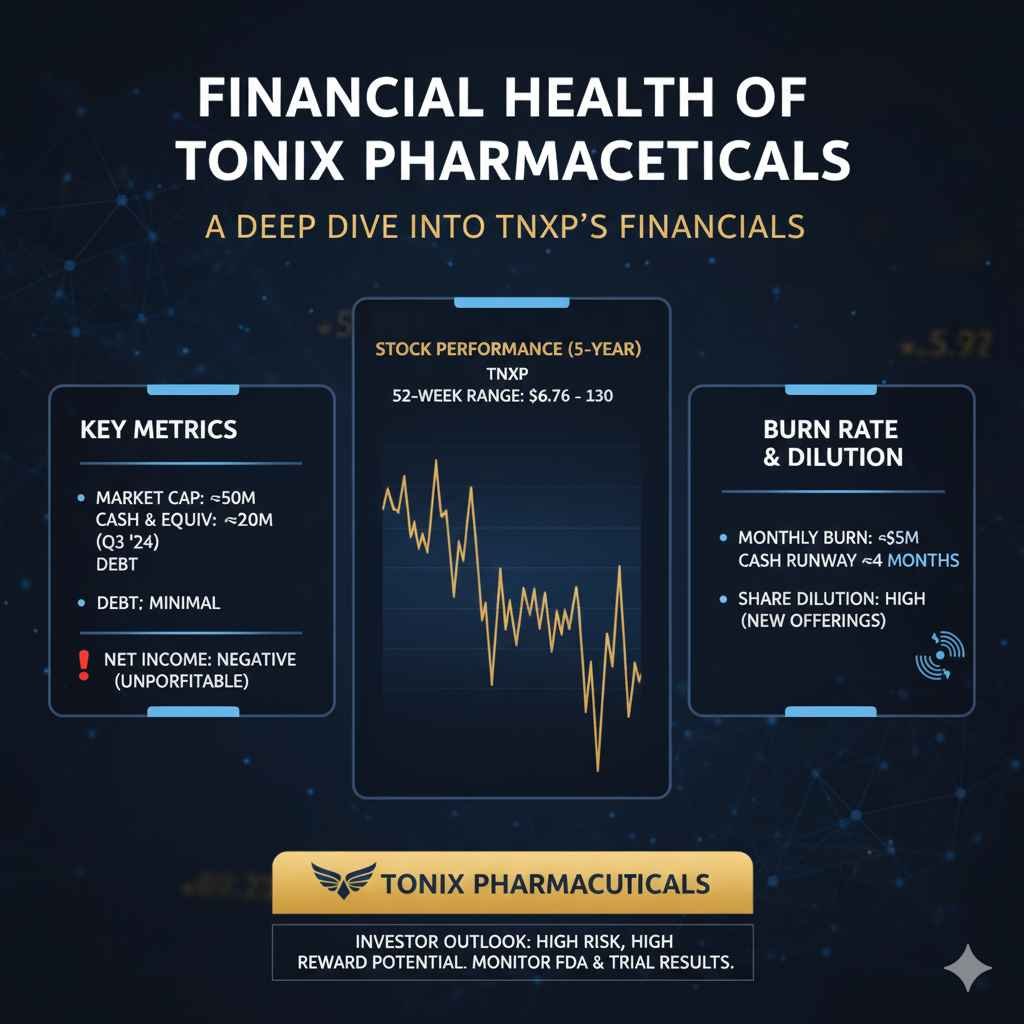

Financial Health of Tonix Pharmaceuticals

Tonix remains in growth mode, with finances reflecting heavy R&D investment. The latest trailing twelve months (TTM) income statement shows revenue of $10.3 million, primarily from early TONMYA™ sales and grants. However, costs are high: $6.8 million in cost of revenue and $99.6 million in operating expenses, leading to a $96 million operating loss.

Income Statement Breakdown (TTM)

| Item | Amount ($ thousands) | Year-Over-Year Change |

|---|---|---|

| Total Revenue | 10,299 | +32.6% (from prior periods, driven by product launch) |

| Gross Profit | 3,534 | Positive but slim margins at 34.3% |

| Operating Income | -96,030 | Improved slightly from deeper losses |

| Net Income | -99,219 | Reflects $6.8 million in other expenses |

| EPS (Basic/Diluted) | -279.15 | Heavily diluted due to shares issued |

Balance sheet highlights include $231.1 million in shareholder equity and no debt, yielding a 0% debt-to-equity ratio—a strong point for stability. Cash reserves support operations, but ongoing losses ($99 million net) necessitate careful capital management. Q3 2025 results: revenue down 8.79% QoQ to ~$2 million, but EBITDA growth of 23.58% signals efficiency gains.

Compared to peers, TNXP’s revenue is low, but its focus on rare diseases (e.g., Prader-Willi Syndrome) could yield high-margin orphans drugs. Risks include burn rate; without profitability, further dilutions could impact TNXP stock.

Quarterly Financial Trends Table

| Quarter | Revenue ($M) | Net Loss ($M) | Cash Position ($M) | Key Highlight |

|---|---|---|---|---|

| Q3 2025 | 2.0 | -25.0 | 225 | TONMYA™ launch boosted outlook |

| Q2 2025 | 2.2 | -28.0 | 240 | R&D spend up 15% |

| Q1 2025 | 2.4 | -24.0 | 250 | Pipeline advancements |

| Q4 2024 | 3.7 | -22.0 | 260 | Pre-launch preparations |

These figures underscore Tonix’s investment in growth, with losses narrowing as commercialization ramps up.

Products, Pipeline, and Innovations

Tonix’s portfolio is diverse, emphasizing CNS and beyond.

Commercial Products

- TONMYA™: Launched November 17, 2025, for fibromyalgia. This sublingual tablet offers non-opioid pain relief, targeting sleep quality. Market potential: $1-2 billion annually in the U.S., per analyst estimates. Early adoption data is promising, with wholesalers stocking up.

Pipeline Highlights

- TNX-102 SL: Phase 2 for major depressive disorder (IND cleared Nov 24, 2025) and acute stress disorder (topline H2 2026).

- TNX-1500: Phase 1 complete for transplant rejection; advancing to Phase 2.

- TNX-2900: Phase 2 ready for Prader-Willi Syndrome (Orphan Drug Designation).

- Preclinical: TNX-1700 (cancer), TNX-801 (mpox/smallpox vaccine), TNX-4200 (CD45-targeting).

A table of pipeline stages:

| Product | Indication | Stage | Expected Milestone |

|---|---|---|---|

| TONMYA™ | Fibromyalgia | Commercial | Ongoing sales |

| TNX-102 SL | Major Depressive Disorder | Phase 2 | Enrollment 2026 |

| TNX-1500 | Transplant Rejection | Phase 2 ready | Trial start soon |

| TNX-2900 | Prader-Willi Syndrome | Phase 2 ready | FDA discussions |

| TNX-801 | Mpox/Smallpox | Preclinical | Further testing |

This pipeline positions TNXP stock for multiple catalysts, though failures could setback progress.

Recent News and Market Developments

Tonix has been active: Q3 2025 earnings (Nov 10) highlighted operational progress, with participation in conferences like Stifel Healthcare. X (formerly Twitter) discussions on TNXP stock often focus on pumps (e.g., target predictions) and fundamentals, with users like @Arhdan9 noting undervaluation at cash levels.

Controversies include stock dilutions, but counterarguments emphasize pipeline value. Recent patents for pox vaccines boosted shares 43%, per MarketWatch.

Risks and Opportunities for TNXP Stock Investors

Opportunities: Growing fibromyalgia market, FDA momentum, and partnerships (e.g., with EVERSANA for launch). If TONMYA™ captures 1% penetration, revenue could surge to $10-20 million annually.

Risks: High burn rate, competition from established players, and regulatory hurdles. Biotech debates often center on trial success rates (~10-20% for Phase 2), so TNXP stock carries uncertainty.

Diversify and monitor SEC filings at tonixpharma.com/ir.

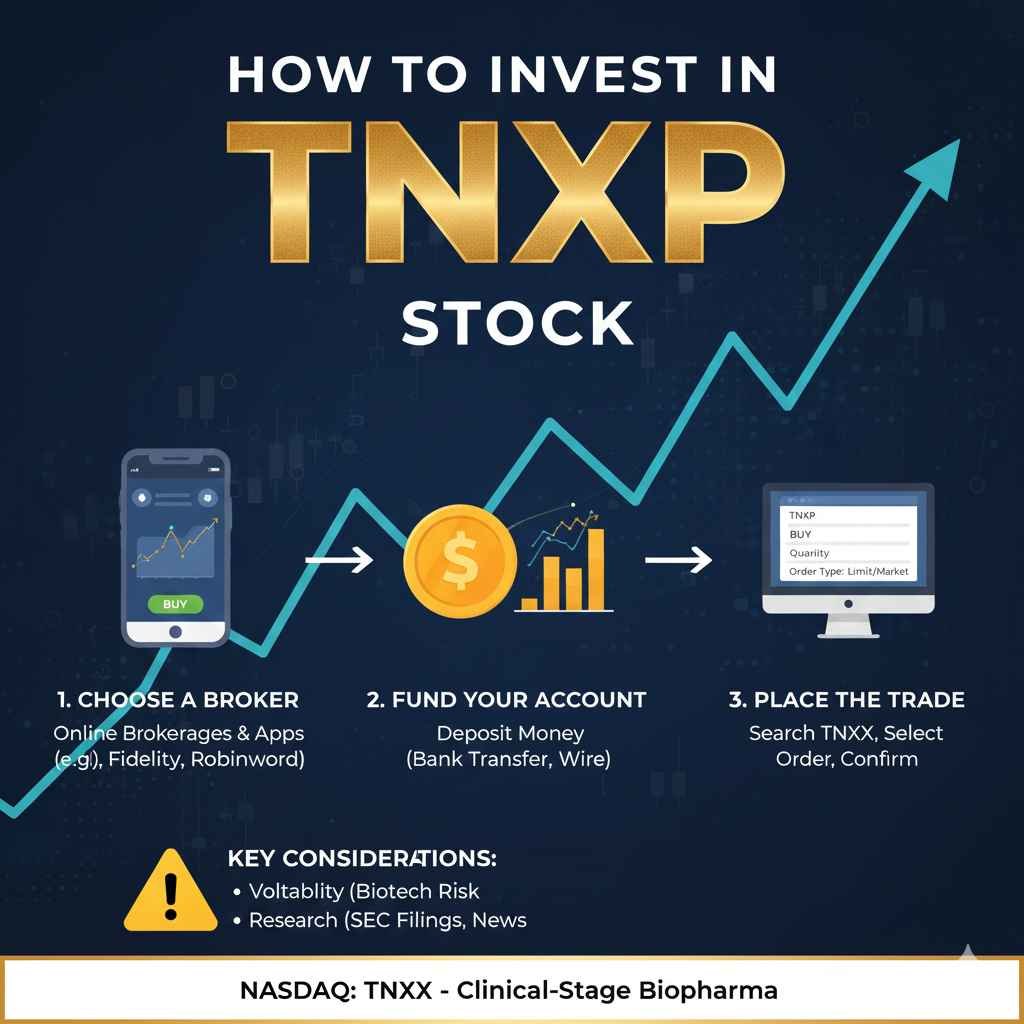

How to Invest in TNXP Stock

Start with brokers like Robinhood or E*TRADE. Research via Yahoo Finance or Nasdaq for real-time data. Consider dollar-cost averaging given volatility. For advanced, options trading on TNXP stock exists, but it’s high-risk.

Frequently Asked Questions (FAQs) About TNXP Stock

What is TNXP stock?

TNXP is the NASDAQ ticker for Tonix Pharmaceuticals, a biotech firm developing CNS and immunology drugs.

Is TNXP stock a good investment?

It depends on risk tolerance. Analysts suggest “Buy” with $70 target, but losses and volatility make it speculative.

What caused recent TNXP stock surges?

Launches like TONMYA™ and FDA clearances, e.g., Nov 2025 IND for depression treatment.

How many reverse splits has TNXP had?

Several, including 1-for-100 in 2025, to maintain listing compliance.

What’s the market cap of TNXP?

Around $230 million, classifying it as a micro-cap stock.

Does TNXP pay dividends?

No, as it’s pre-profit; focus is on growth.

Where can I find TNXP financial reports?

On their IR site (ir.tonixpharma.com) or SEC EDGAR.

Final Thoughts

TNXP stock embodies the excitement and uncertainty of biotech investing. With TONMYA™ now available and a robust pipeline, Tonix could emerge as a key player in pain management and beyond. However, financial losses and market risks remind us to approach cautiously. If you’re bullish on innovative therapies, TNXP stock warrants consideration—do your due diligence and stay informed. As always, consult a financial advisor before investing.